Stimulus for development for the property market in Paris

The Netflix series Emily in Paris enticed international investors into the Paris property market. US American investors are paying premium prices for apartments close to the filming locations. But the Paris property market will see further highlights in 2024. After a hundred years, the Olympic Games are to return to the city. At the same time, Paris will be laying the foundations for a radical upgrade and renovation of its public transport network with one of the biggest infrastructure projects in Europe – the Grand Paris Express. This will have a positive impact on the property market and stimulate new development. There are also signs of polarisation in the market. While central locations show strong dynamic, in secondary submarkets the consequences of the slowdown of the economy are more evident.

Grand Paris and Olympia 2024 as growth drivers

The construction of the Grand Paris Express will add five new metro lines, which are intended to link the major residential and business districts in the outer suburbs of Paris and take the burden off the city centre transport system. This will stimulate the development of new office, retail and residential locations along the orbital network. Examples are the urban campus as part of the science and technology cluster of the Paris-Saclay University (450,000 sqm of office space); the Les Groues quarter (225,000 sqm of office space, 340,000 sqm of residential space and 65,000 sqm of retail space) and the Campus Grand Parc as a biotech location (150,000 sqm of office space). A further 365,000 sqm of office space will be created in the new urban quarter Les Ardoines. The commissioning of the first line is planned to coincide with the beginning of the Olympic Games, with completion of the project as a whole planned for 2030. The Grand Paris Express will further strengthen the role of Paris as an important European commercial centre.

„Paris city accounts for 2 million inhabitants, but there is much more to Paris urban area. The Grand Paris public transportation network will enhance the investment opportunities in the Paris region through the creation of new centralities, as centrality proves more desirable than ever“ (Alexandre Guignard, Investment Management France)

The Olympic Games are another major economic driver in the metropolitan area. The games will be spread throughout various destinations in Paris in the period from July to August 2024. High investment in infrastructure, transport and sports facilities will provide an important impetus for the development of the real estate market. One example of new development is the Olympic Village in Saint-Denis, where construction is underway for retail space in addition to around 2,800 apartments and office space for 6,000 people, which will contribute to the upgrading of the outskirts of Paris.

Central Business District of Paris – a prime example of the high demand for central locations

The office market in Paris will benefit from the above-mentioned investment in infrastructure and development projects. Despite the continued weakness of the economy, a slight recovery in the demand for space can already be seen. The vacancy rate of the overall market was 9.9 % in the fourth quarter of 2023. An interesting trend is developing in the central business district (CBD) of Paris: at the end of 2023 the vacancy rate fell to a new record low of 2.8 % (see figure 1), triggered by a new record take-up of office space at more than 50% of the total space let. The demand for city-centre locations has grown further, primarily as a result of the trend towards working from home. Companies still see the office as a place for collaborative and productive work. They are anxious to create the best possible conditions for their employees. Central locations offer the advantage of an attractive environment with a wide range of leisure and local amenities while being very easy to access. The shortage of skilled labour has also increased the demand for city-centre office space as companies are competing for qualified staff. Therefore, attractive office locations in city centres are a key criterion for successful recruitment.

This has coincided with a decline in the supply of new space. Construction delays have held up the completion of high-quality office spaces and further increased the competition for central, modern office space. The limited supply has caused tenants to pay higher rent increases, with rents for first-class spaces in the central business district having increased by around 16 % since the end of 2021, while rents in the secondary submarkets (La Défense and Western Business District) have mostly remained stable due to higher vacancy rates (see figure 1/2). This has resulted in a widening of the gap between central locations and secondary locations. Further increases in prime rents can be expected in the future owing to the shortage of available space and the limited amount of construction activity. As France has a relatively low percentage of remote workers in the European context this could also have a positive impact on rent growth.

„Paris CBD combines a low letting risk with solid rent reversion prospects, making Paris CBD a top destination for core and value-add money" (Alexandre Guignard, IM France)

Seizing investment opportunities in the core segment

The increase in the interest rate has had a negative impact on the investment market. At the end of 2023, the investment volume in the Paris office market was around 70% below the 10-year average. However, the Central Business District continued to account for more than half of the investment volume. This shows that interest among investors remains high and also reflects the liquidity of the area.

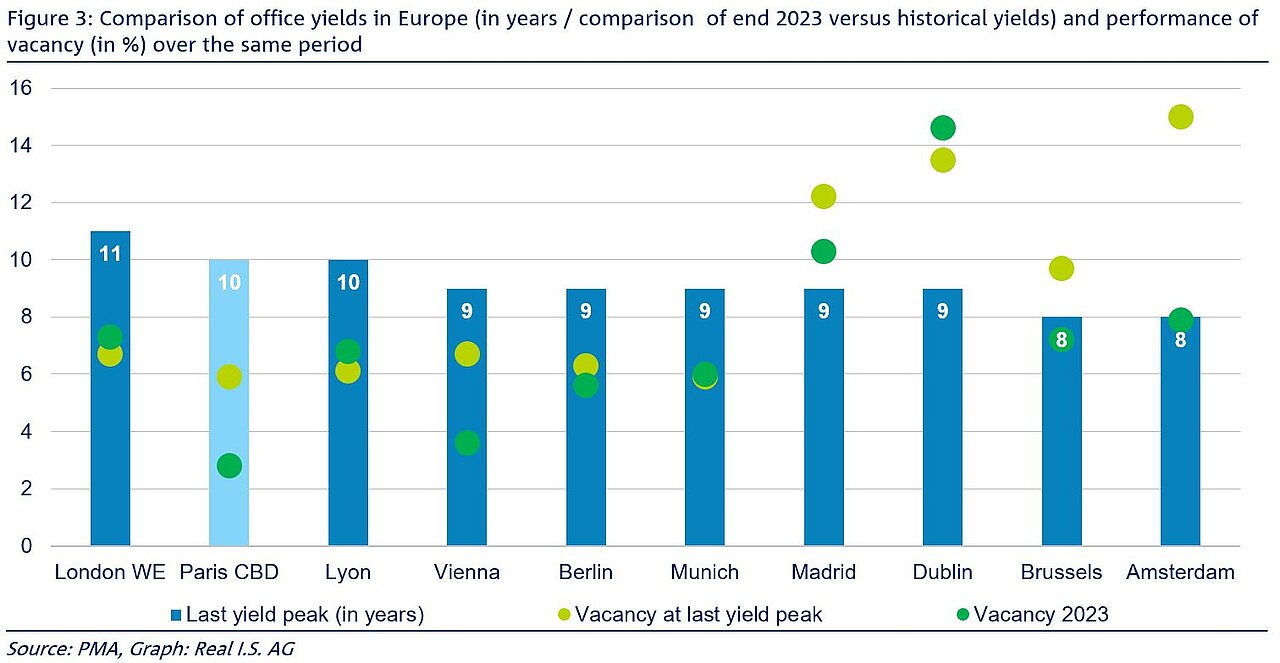

The investment market is expected to gain momentum in the course of the year. Higher real estate yields in conjunction with anticipated interest rate declines offer a time window for attractive investment opportunities at present. In the CBD of Paris, prime yields for office real estate rose by around 170 basis points to 4.3 % between the previous low in 2021 and the end of 2023. At 4.3 % this marks a ten-year high for yields, which have not hit such heights since 2013 (see figure 3). By historical standards, therefore, the CBD of Paris offers after London’s West End currently good investment opportunities in a European comparison (change in interest rate is not taken into account here). A comparison of the historical yields with the historical vacancy rates shows that the CBD of Paris has a far lower vacancy rate than in 2013, with similar yields. In 2013, the vacancy rate stood at 5.9% and fell to 2.8% at the end of 2023; yield was at 4,3% in 2013 and 2023. In Dublin, for example, the current yield of 5% was last achieved in 2014, while in 2014 the vacancy rate at 13.5%, was below the level recorded at the end of 2023 (14.6%). In a European comparison after Amsterdam, the CBD of Paris and Vienna are the markets with the greatest drop in vacancy rates in addition to the lowest absolute vacancy rate at the end of 2023, accompanied by historically high yields.

Summary

This year’s focus is on Paris. Not only because of a popular Netflix series, but because important events, such as Olympia and the Grand Paris Express project, boost the economy and the real estate market, and thus generate demand. Paris CBD scores with a very stable and resilient occupier market. There is a high likelihood that rents will increase further and thus ensure safe cash flows due to high space turnover, a record vacancy low and the less pronounced inclination to work from home. Yields in the CBD are at a 10-year record level on the investment market. This offers attractive investment opportunities for investors in a liquid market with growth potential.