Dublin is not only one of Europe’s most liveable cities; in the past ten years it has also seen huge economic and population growth. The supply of housing has not kept up with this growth, so rents for houses and apartments have increased significantly. This positive trend in the residential market has been reflected in the investment market, as the volume of transactions in Ireland has grown considerably since 2018.

Economic fundamental data indicate a high demand for residential properties

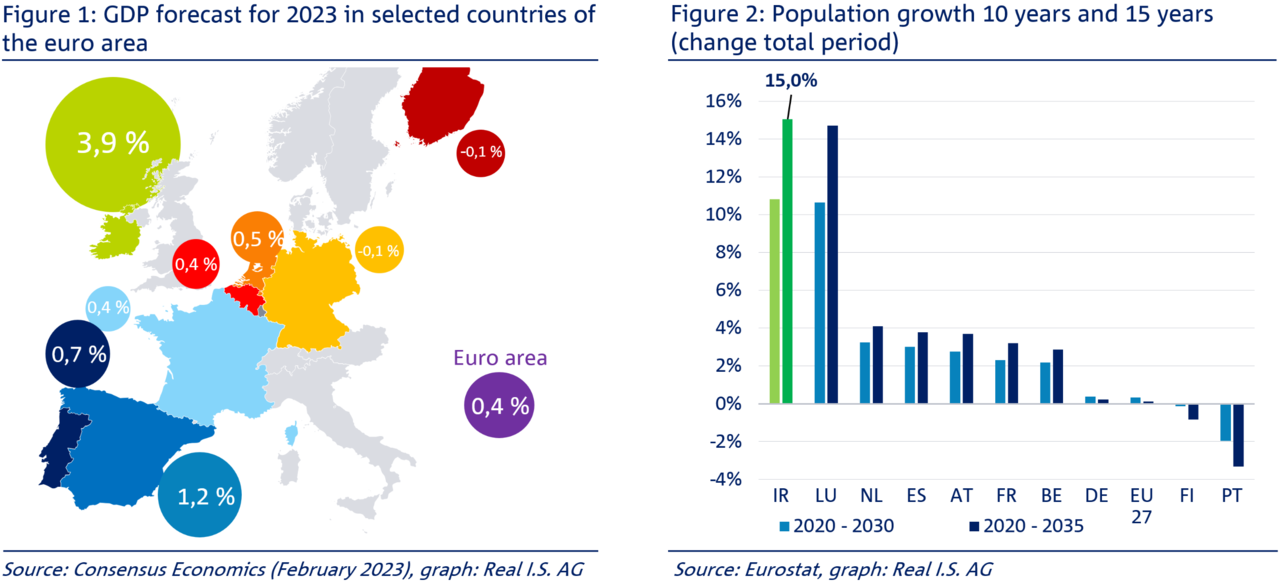

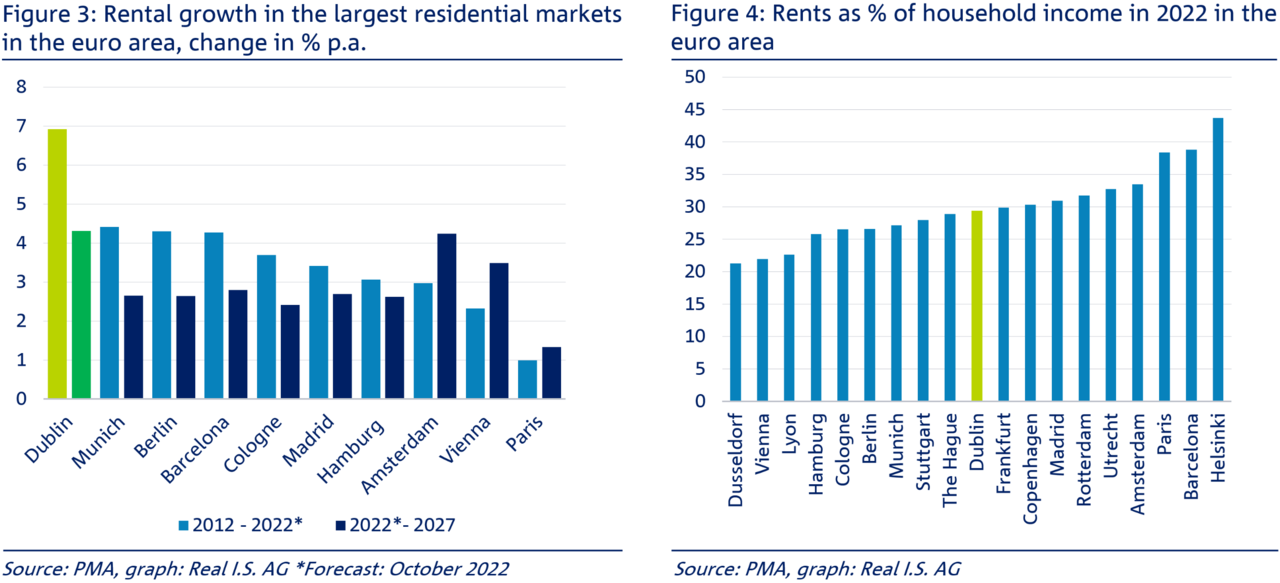

Ireland has recorded the strongest gross domestic product (GDP) growth in the euro area for the past four years. This year, economic growth is expected to be 3.9 % – significantly higher than the euro area average of 0.4 % (see figure 1). Ireland has also experienced strong population growth during the past ten years (up 10%), matched in the euro area only by that of Luxembourg. This has been driven by both a high birth and immigration rate. The latter was boosted by the strong influx of skilled labour from other countries, which has been stimulated mainly by the tech scene. The layoffs in the technology sector have so far had little impact on the Irish property market. The majority of the companies are long established in the city; also, location factors such as access to the EU market and the fact that Ireland is an English-speaking country will remain important drivers of demand. Demand should also remain high in Ireland in the long term. Further population growth of around 15% (see figure 2) is expected by 2035. The economic fundamentals are key drivers of the housing demand, which should therefore remain high.

Strong growth in rents expected – Dublin 8 as highly promising submarket

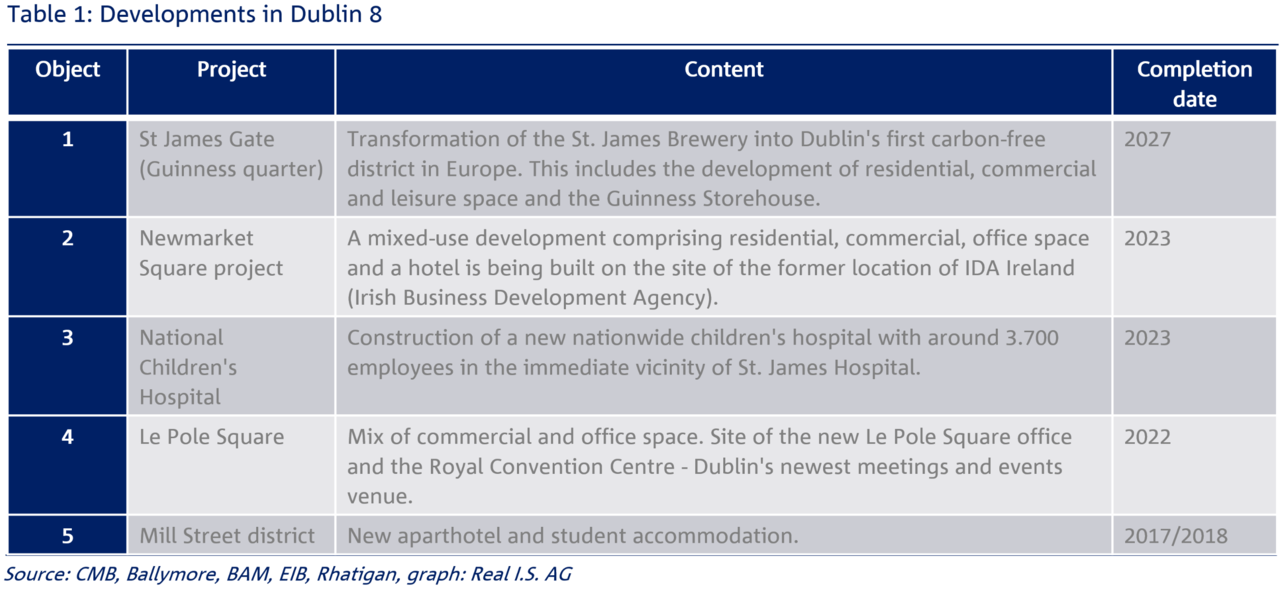

High demand along with a low offer of new building plots has led to a shortage, resulting in an outstanding increase of around 7% p.a. in residential rents in Dublin in the last ten years (see figure 3). This represented the strongest growth in rents at all in the euro area. Yet rents remain at a reasonable level in comparison with incomes. Figure 4 shows an analysis of rents as a percentage of household income where Dublin is ranked in the middle of all the cities. This shows that residential rents are still affordable in the European context and therefore achievable on a long-term, sustained basis. The main reason for this is the strong income growth of employees in the technology and financial sector.

According to PMA, residential rents in Dublin should continue to increase even beyond the five-year forecast period at an annual rate of around 4%. Nowhere other than Amsterdam are rents expected to grow faster (see figure 3). The main drivers of the rent increases are the high population growth forecast and the low supply of housing.

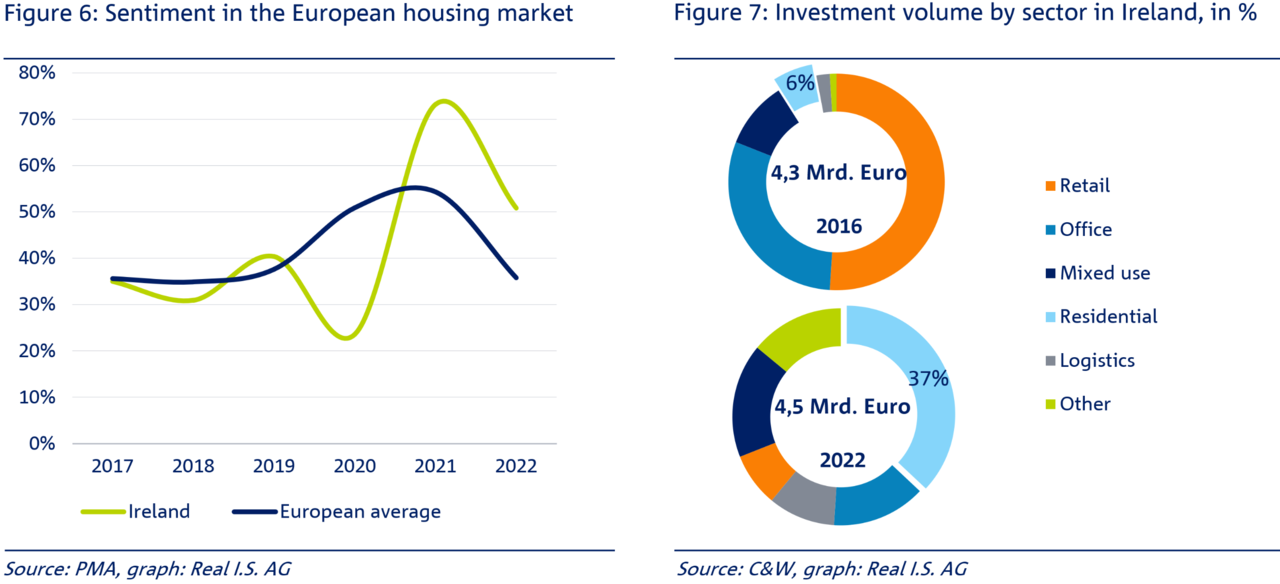

A submarket that should especially benefit from further rent increases in the coming years is Dublin 8. Knight Frank expect rents to go up by 20% within the next five years. At present, this submarket is undergoing transformation from a historic working-class area into a vibrant submarket. Former industrial plants and vacant sites are giving way to new commercial uses, residential areas, student housing, hotels and visitor attractions. A large number of developments in this area are currently contributing to its gentrification and making it more attractive (see figure 5 / table 1).

Dublin 8 is particularly attractive due to its walking distance to the urban business districts and its closeness to the LUAS Green line at St. Stephen‘s Green. It is home to the headquarters of the world-renowned Guinness brewery, a popular comedy club, Christ Church, St. Patrick's Cathedral and the Teeling whiskey distillery. The appealing local conditions in Dublin 8 thus offer investors potential for further rent increases in the future and investment opportunities.

Attractive investment market and high yield potential

According to a survey of European institutional investors by PMA, sentiment in the Irish residential market has been very positive since 2021, and significantly higher than the European average (see figure 6). This is also reflected by the trend in the investment volume. Institutional investors have only been operating in the market on a large scale since 2018, when the EUR 1 billion mark has only just been passed. In 2016, the residential segment only accounted for around 6% of the total property investment volume in Ireland. In 2022, this had risen to 37%, with invested capital of EUR 1.8 billion (see figure 7), making the residential sector the asset class with the highest level of investment in the Irish property market (source: Cushman & Wakefield). The multi-unit residential segment accounted for more than half of the transactions; the social housing segment around 15%, and student accommodation 10% (source: Knight Frank).

Most of the investment activity in the Irish residential market (between 40% and 80% since 2018) is driven by forward deals. The reason for this is the lack of housing stock available for investment, thanks to the small number of housing completions and the relatively high rate of owner-occupancy (around 70%). However, the significant increases in construction and financing costs are expected to result in fewer completions and thus fewer forward deals in 2023, which could put further pressure on rents.

Increasing interest rates, high inflation and economic concerns all had an impact on the trend in European property markets in 2022 and resulted in falling prices along with increasing prime yields. In the biggest residential property markets, average net yields in Dublin remain among the highest in the euro area, this offers good opportunities for long-term investments (see figure 8).

Conclusion: this Irish residential market provides attractive yield opportunities to investors

High demand accompanied by low supply has led to a sharp increase in rents in Ireland during the past ten years. The high population growth forecast for the next five years will give rise to further increases in residential rents, with the result that Dublin will have the fastest-growing rents in the euro area. Ireland continues to offer a liquid investment market with average net yields higher than the European average. The Celtic Tiger, the name by which Ireland has been known for some years due to its rapid growth, thus offers investors an attractive portfolio addition with a high level of security.