When the office markets were just starting to recover after the slump in demand in the COVID-19 crisis, factors such as the difficult economic climate, a noticeable rise in capital market interest rates, sustained high inflation, disrupted supply chains and high geopolitical risks resulting from the Ukraine war at the beginning of 2022 led to a great deal of uncertainty in the business community.

However, in contrast with the pandemic, these factors no longer led to questions about the future viability of office buildings in general. In hybrid working models, the office plays an important role in its function as a catalyst for communication, collaboration and innovative ideas. Attractive office locations have become a competitive advantage in the recruitment of qualified employees and as an incentive for staff loyalty. For users this is reflected in the increasing popularity of core properties, in other words, high quality buildings in central locations with attractive nearby shopping facilities, and this continues to drive the growth of the top rents in almost all markets. On the other hand, however, it seems that there is a widening gap between modern office buildings in prime locations and properties in secondary locations, where demand shows a falling trend.

Office rental markets continue to show solid fundamental data

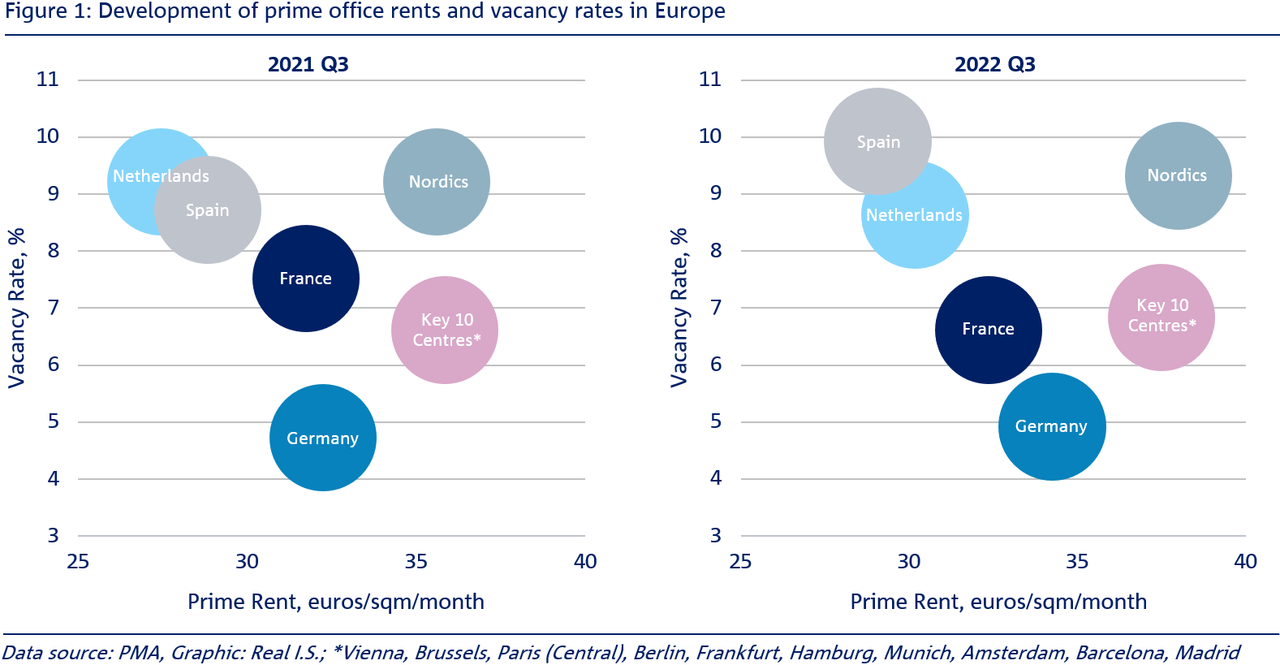

On European office markets, the rise in vacancy rates had already slowed down in 2021 and by the third quarter of 2022, the vacancy rates had stabilized, and, in some markets, they had even started to fall. At the end of the third quarter of 2022, the average vacancy rate in Europe (without the UK) was unchanged at 8% compared with the same quarter in the previous year, which means that it remained moderate in comparison with earlier crises. The vacancy rates were below 7% on average in the Key 10 Centres, among which were Hamburg (3.8%), Munich (3.9%), Berlin (4.0%) and Vienna (4.1%). However, there was a rise in the supply of office premises, especially in the Spanish markets (see figure 1).

In spite of the above-average vacancy rates in some European capital cities – such as Paris (8.7%) or Madrid (9.9%), there is still a lack of large and modern office space in the central business districts, especially because a sustained high demand for central office premises can be expected.

The steep rise in building and financing costs means that construction activities are expected to decline in 2023 and beyond, which is likely to heighten the shortage in the supply of office premises in central locations.

As a result of the lack of prime office space in central business districts and the high construction costs, European prime office rents (without UK) went up by an average of 5.3% between the third quarter of 2021 and the third quarter of 2022, although these results also show the increasing spread between prime office premises and secondary premises. The biggest rental increases were experienced in Stuttgart (+11%), Amsterdam (+10%) and in Rotterdam and Berlin (both up by 9%). In a country comparison, this trend was strongest in the Netherlands, which showed the largest growth in rents (+10%) by a considerable margin (see figure 1). But a very positive rent development was also observed in Scandinavia (+7%) and in the seven German A cities (+6%). Spanish markets, which had suffered during the COVID-19 crisis, saw a slower growth in rents (up by 1%). The top rents in the ten key markets rose by an average of 4.5%.

As a result of the significant slowdown in the economic situation, a rise in vacancy rates is expected in the European office markets by the end of 2022 (Data for the fourth quarter was not available at the time of writing). However, especially modern office areas in central locations are still expected to be in high demand. Combined with slight relief in auxiliary costs (first of all electricity and gas), a continued upsurge in prime rents is therefore anticipated for 2023.

Interest rate turnaround and uncertainty in price developments hamper office investments

Up to the end of 2022, a total of EUR 96.1 billion was invested in European office premises. Office buildings therefore again showed the highest demand of all asset classes, even though investments were about 15% less than in 2021. Continued stability in the turnover of office space and significant rent increases in some areas, combined with moderate vacancy rates, still make this asset class attractive for investors. Nevertheless, the usual year-end rally did not occur in 2022 due to the higher risk factors resulting from the war in Ukraine, recessive global trends, the noticeable rise in financing costs and, in some cases, the sharply contrasting price expectations of purchasers and vendors. Therefore, the investment volume in the fourth quarter of 2022 (EUR 18.1 billion) was 58% lower than in the same period in the prior year. It must be emphasized, however, that the fourth quarter of 2021 saw a transaction volume of EUR 43.6 billion, which was the highest result ever recorded.

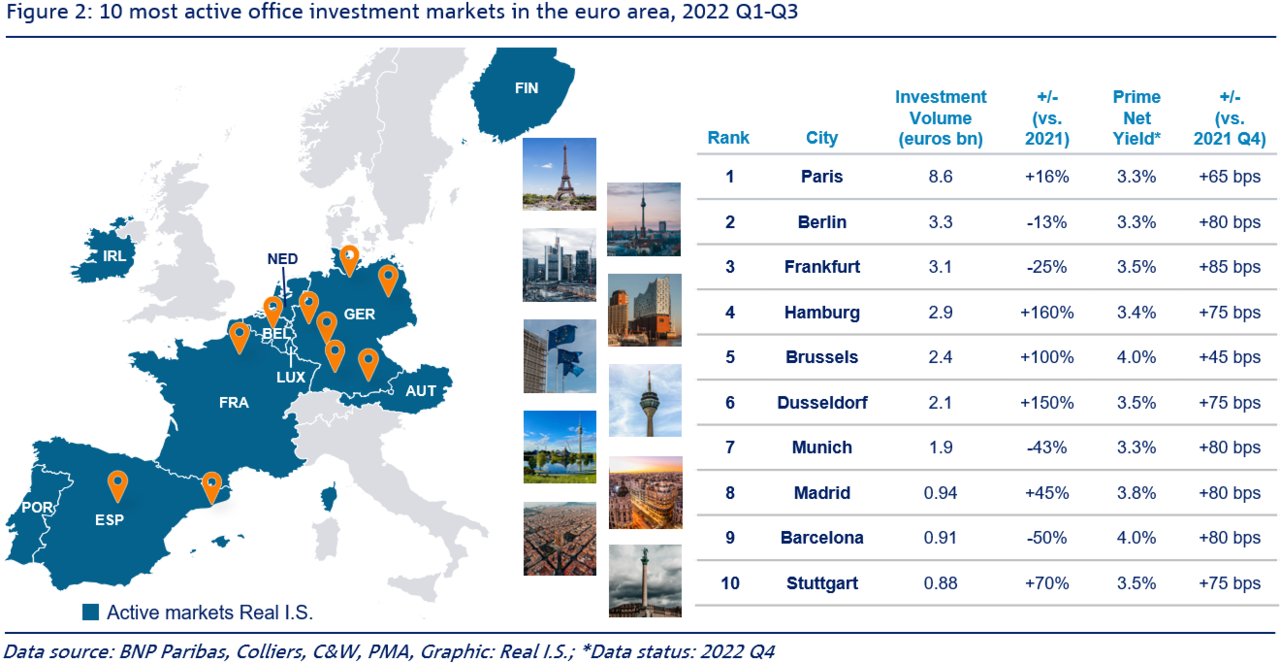

In the ranking of markets with the greatest liquidity in the euro area, Paris takes first place by a long way, with an office investment volume of EUR 8.6 billion in the first nine months of 2022 (see figure 2). In Germany, the regional focus for office investments compared with other asset classes is clearly on the top locations. Together they represent a share of 19% of the total office investment volume, although only Hamburg, Dusseldorf and Stuttgart showed an upsurge compared with the same period of the previous year.

Rising interest rates, high inflation and concerns about the economic climate had a noticeable effect on the dynamic performance of the European investment markets in 2022. Consequently, according to the real estate research consultancy PMA, the top yields for office premises increased in 20 of 21 markets in the fourth quarter of 2022 (see figure 2). The top yield (net) in the euro area is now 3.8%, and thus 30 base points higher than in the third quarter of 2022 and 60 base points above the figure of end-2021.

In a comparison of the office markets in the euro area, Paris, Berlin and Munich are still the most expensive markets, with a current yield of 3.3%, followed by Hamburg with 3.4%. In Frankfurt am Main, Dusseldorf, Stuttgart and Vienna, the top yield is now 3.5%, and in Amsterdam it is 3.7%. A figure of 3.8% is registered for Madrid.

Which topics are of interest to real estate investors both in the short and medium term?

In the framework of the annual study Emerging Trends in Real Estate Europe, carried out by PwC and the Urban Land Institute, managers and executives from the European real estate sector were asked about their expectations for 2023 and the coming years in the context of the current economic and geopolitical crisis situation.

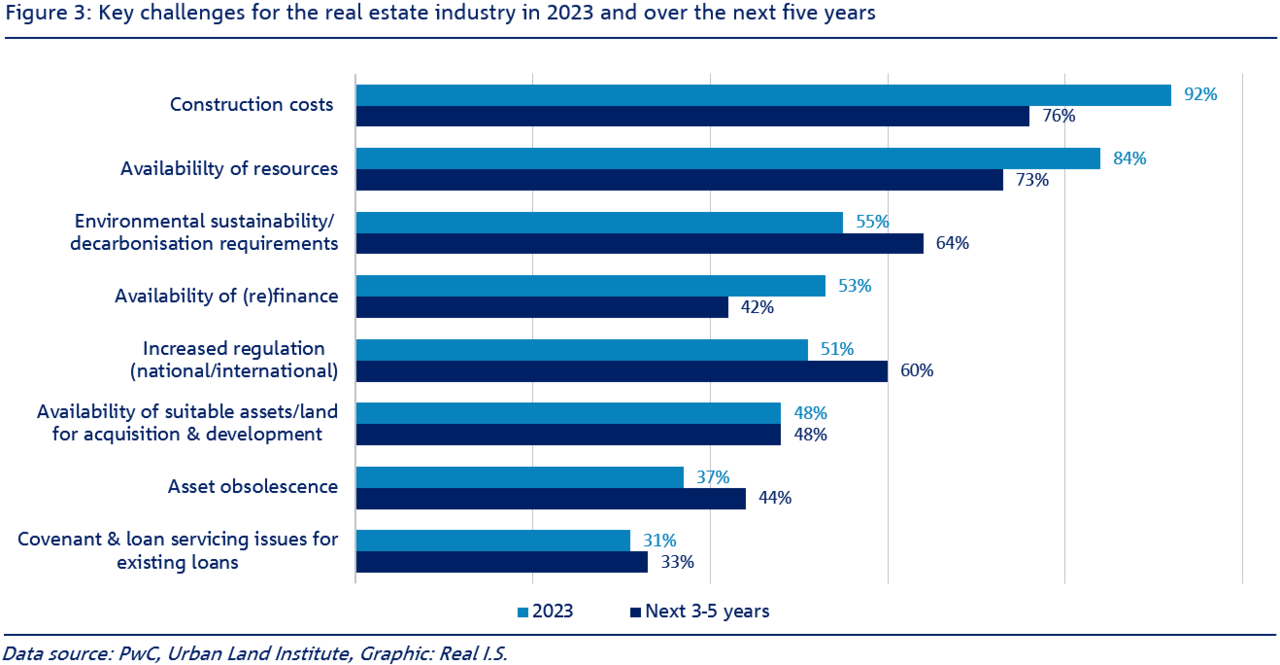

The respondents identified building costs (92%) and the availability of resources (84%) as the central challenges for the real estate sector in 2023 because of the current shortage of materials and personnel and the resulting pressure of inflation (see figure 3). Although construction costs have been in the focus of the industry for years, the existing problems in the supply chain have become even more acute due to the war in Ukraine, especially for the supply of fuels, copper and aluminum.

The results of the survey also indicated that no significant improvements are expected in the building sector in the next three to five years. About three quarters of the respondents believe that construction costs and the availability of resources will continue to be a critical topic in this period.

In spite of the macro-economic uncertainty, ecological and sustainability strategies still have highest priority in 2023 for most market leaders in the real estate sector. For more than half of the respondents, climate and environmental risks are the greatest challenge for the real estate industry. It is surprising, however, that 45% of the respondents do not yet see this as a problem today, although it will probably influence their long-term strategy. 64% of those surveyed expect sustainability requirements and regulations to be a key challenge during the coming three to five years. The less critical real estate experts cite the inflationary trends in the market as their greatest short and medium-term concern, and they regard environmental topics as more relevant in the long term.

The likelihood of stronger regulations regarding environmental, social and corporate governance (ESG) related aspects has been a recurring topic of the Emerging Trends in Real Estate Europe study for many years. But the present survey indicates a significant change in their importance for the industry. Half of the respondents is of the opinion that the issue is of relevance in 2023, and for as many as 60% of those surveyed it represents a major challenge in the medium term.

Conclusions & outlook

As expected, the first six months of 2023 will still be marked by the continuing weak economic phase, further increases in the base interest rate and rising financing costs. As a result, the market environment for property investments is likely to continue to be challenging. The market is currently going through a re-evaluation phase, and investors are cautiously planning their return to the market. As soon as financial markets have stabilized and inflation has been brought under control, the assessment phase for new prices will accelerate and will again lead to an increasing investment demand, especially because the fundamental data for the office rental markets are still proving solid. This means that the investment volume is likely to pick up speed again in the second half of the year. In the first half of the year, however, a continued increase in yields can be expected.