Economic crisis leaves its mark on the investment market

There is no shortage of bad news about the United Kingdom at the moment. The political troubles and the increase in interest rates have led to low sentiment among companies and households. As a result, economists are expecting the UK to enter a recession this year (a 0.6% decline in gross domestic product (GDP), according to a survey by Consensus Economics in January). The difficult economic situation has also left its mark on the investment market for office properties: in the past quarter, transaction activity in London almost came to a standstill at GBP 0.7 billion.

As so often in market phases of this kind, the situation presents opportunities for investors. In the UK, properties are often financed on a shorter-term basis than, for instance, in Germany. The significantly higher capital costs are therefore leading some property owners to put their properties on the market to avoid expensive rollover funding. However, there is little demand, and prices for office buildings are going down significantly as a result, particularly in London. Current property listings show that prices for core office real estate in central London have declined by around 20% in comparison with last year. To assess which locations in London offer the best risk/reward ratio in this market environment, it is worth looking at the rental market, which exhibits greatly diverging trends in the relevant submarkets.

The rental market West End/Midtown shows a strong performance

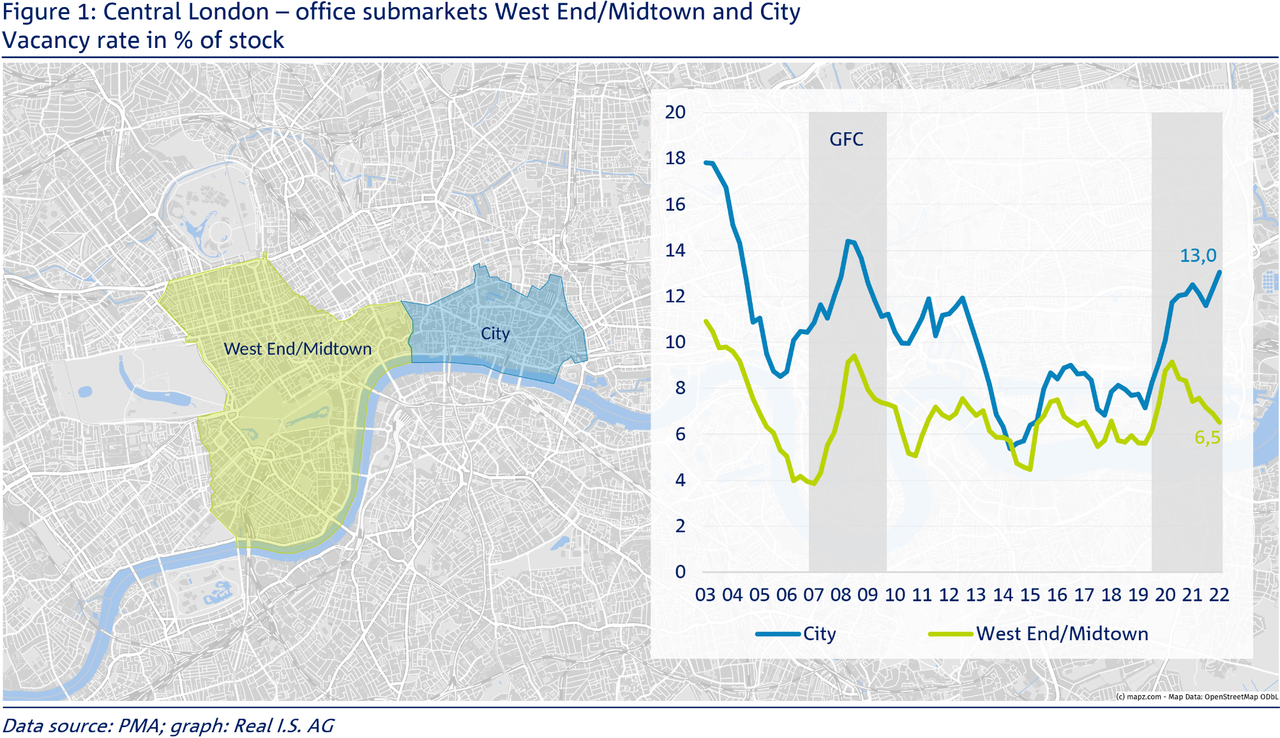

Over the past 20 years, vacancy rates for offices in the large West End/Midtown and City submarkets of London have always risen or fallen in tandem. However, in recent quarters the trends have diverged: the vacancy rate in the City submarket is on the rise and currently stands at 13.0%, while in the West End/Midtown submarket the vacancy rate is on a downward trend and stands at 6.5% (see figure 1). Whereas the City is suffering from post-Brexit job cutbacks in the financial services sector as well as the large new development pipeline, in the West End/Midtown, IT sector tenants, law firms, Government tenants and also financial services companies such as hedge funds have induced a surge in demand, resulting in a decline in the vacancy rate.

This picture is reflected in rents, which are going up now (including effective rents – although lease incentives remain high, effective rents are currently also rising, albeit at a significantly more moderate rate than nominal rents).

The initial yields are higher than long-term averages

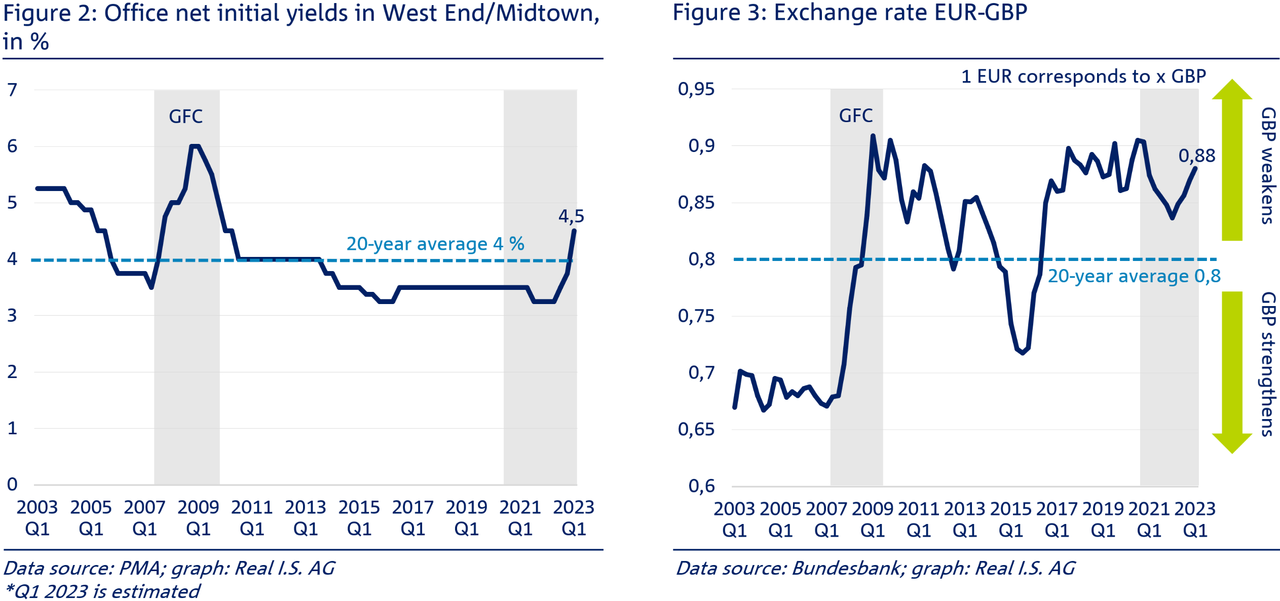

Given this positive rental market environment, the price correction in the West End/Midtown submarket of London offers investment opportunities. According to real estate research consultancy PMA, the prime yield in the fourth quarter of 2022 was 3.8%. The most recent property listings point to a significant price correction in the first quarter of 2023. It is estimated that the prime yield has risen to between 4.25% and 4.5%. For comparison: at the beginning of 2022 the prime yield was only 3.3% (see figure 2).

Looking at the current yield level in the historical context, it can be seen that the prime yield is above the historical average. The average in the West End/Midtown submarket over the past 20 years was 4%. There is therefore long-term potential for price increases, with a high current cash-flow yield.

The weak pound makes investments more attractive

From the point of view of an investor in the euro area considering investing in the UK property market, the exchange rate and the historical trend in the exchange rate also have a role to play. Sterling has fallen significantly against the euro in recent years.

One euro is currently worth 0.88 pounds sterling (see figure 3 above). The average euro-pound exchange rate over the past 20 years was 0.8. If the exchange rate moved towards the long-term average, there would therefore be potential for a 10% increase in the value of the pound.

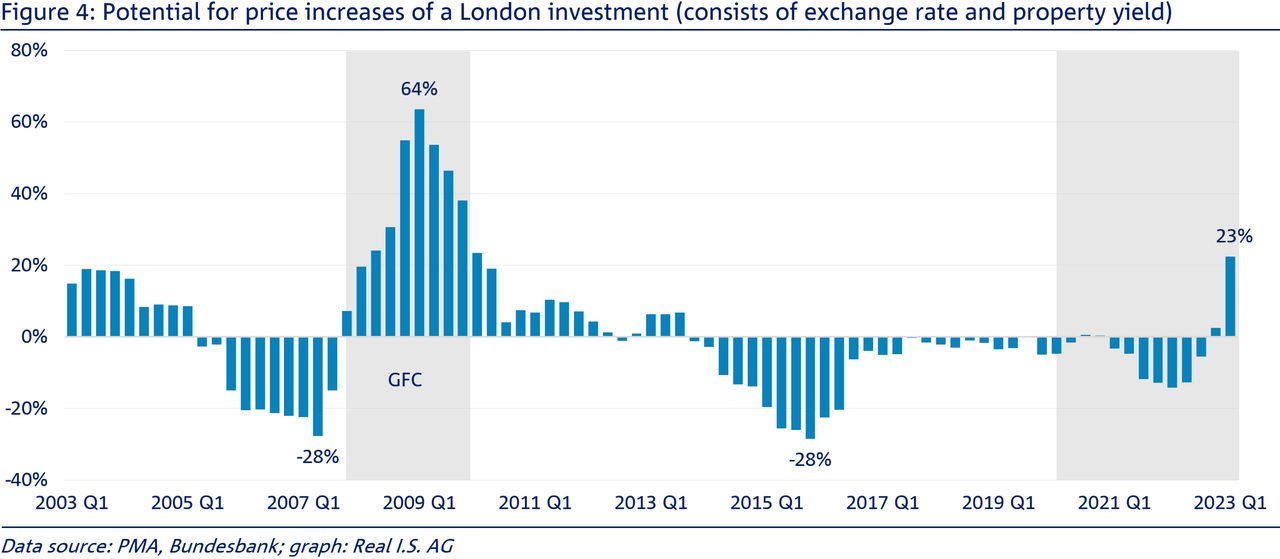

The price increase potential in euro is 23 % according to the mean reversion model

The combined potential for price increases on a UK investment can be calculated on the basis of the yield and exchange rate alignment components. In a theoretical analysis, the initial yield would then move back from the current level towards the long-term average (= mean reversion); similarly, the pound sterling would appreciate against the euro again from its current exchange rate to the long-term average. In euro, this would currently result in an aggregated price increase potential of 23% for an office investment in the West End/Midtown submarket. Figure 4 shows that this potential is lower than during the financial market crisis in 2009 – at that time the potential peaked at 64%. However, with a 4.2% fall in GDP in 2009, the rental market was then also under significantly greater pressure and as a result the decline in prices was more marked.

Conclusion: investors should take advantage of opportunities

The United Kingdom is currently in a difficult economic situation. Added to this is the sharp rise in interest rates. In this environment, office buildings in London are currently seeing a significant price correction. A further issue is the falling value of the pound. However, the occupier market in London’s West End and Midtown areas is currently very stable. As a consequence, investors can take advantage of the price correction without having to take excessive risks in the occupier market and thus also the risk of falling rents and increasing vacancy rates. In the medium term, this combination offers considerable potential for price increases once the economy recovers. One of the greatest virtues of the British is their adaptability, which suggests that this latest period of economic weakness will not last long. This is also backed up by the historical data: over the past 40 years, recessionary phases have always been of short duration; each period of economic weakness has rapidly been followed by a pick-up in economic activity.