Where does the expression ‘pack your bags’ come from? (The German phrase is literally ‘pack your seven things’). Quite simple: there are seven good reasons to invest in hotel real estate at this time. Even though the hotel industry is currently still facing a number of challenges such as the last effects of the Covid-19 pandemic, shortage of skilled workers, increased labour costs, energy crisis and inflation, the hotel asset class has proved to be more resilient than other types of use. This is also proven by the Deutsche Hypo Real Estate Climate Index in June 2023: at 83.7 points, the hotel climate index is significantly above the asset classes ‘office’ and ‘retail’ (each 58.5 points). So, pack your bags quickly and go!

(1) Recovery in demand

As travel restrictions have been lifted, demand for tourism has recovered substantially. In Europe, revenue per available room (RevPAR) reached 97% of pre-Covid levels last year (source: CBRE). The strong driver of this trend was mainly inflation-related growth in average daily room rates (ADR), while room occupancy rates still lagged behind the record year 2019. A revival of Asian tourism is expected in 2023/2024, with the result that a full recovery of the hotel market (RvPAR) is forecast for 2024.

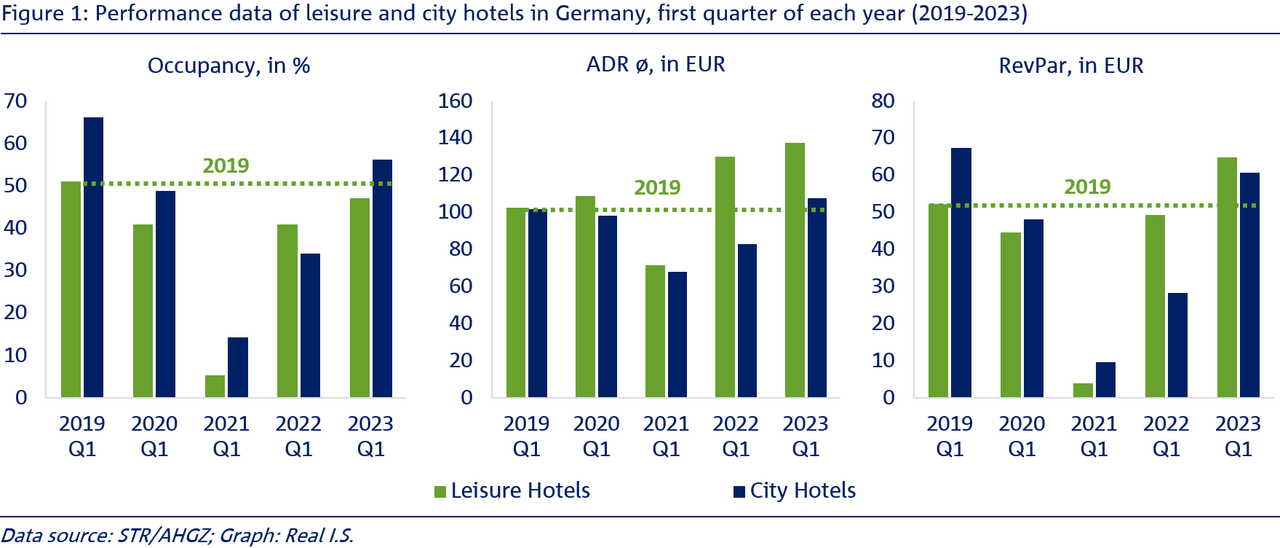

Room occupancy rates and revenue per available room have performed differently in the city and leisure hotel industry since 2020/2021. In Germany, three cities (Berlin, Munich and Hamburg) were still among the top 5 most popular travel destinations in 2019, while holiday regions such as the Baltic and North Sea, the Allgäu, Western Pomerania and the Baltic coast of Mecklenburg were in high demand in 2020 and 2021. This reflects the increased trend of earthbound travel (by car, train and bus) since the beginning of the pandemic. This has benefited the leisure hotel industry in particular, as well as tourist-focused city hotels. For example, bed occupancy in the leisure hotel industry rose to 47% in the first quarter of 2023, just below the level (51%) recorded in the first quarter of 2019. The room rate in first quarter of 2023 even exceeded the pre-Covid level by 34% (see figure 1, middle chart). The price increase therefore more than compensated for the lower occupancy rate, leading to a significantly higher RevPAR in Germany. This even exceeded the record year 2019 (see figure 1, chart on the right) (source: AHGZ/STR). The rapid and significant recovery in demand demonstrates a relatively high resilience compared to the city hotel industry, but also to other asset classes.

(2) Low level of new supply

On the one hand, demand is recovering, but on the other, hardly any new hotels are coming onto the market at present. Increased construction costs and more difficult financing conditions have led to some construction delays and cancellation of projects. The growth of the hotel stock in Europe in 2022 was already low, at less than 2% of the existing stock. The most hotels were completed in Spain, France and Germany in 2022. While a few more hotel openings, about 2.5% of the stock, are expected in 2023, the growth of new supply in Europe remains very moderate (source: Cushman & Wakefield). If demand is maintained, this will lead to higher room prices in the medium term and boost the attractiveness of hotel properties in the investment market.

(3) Long-term and stable cash flow

In comparison with other use types, such as office or logistics real estate, hotel properties have particularly long-term rental or lease contracts with terms between ten and more than twenty years (different from hotels with management contracts without operators and the owner directly participating in the hotel performance). For this reason, hotel investments are particularly suitable to stabilise real estate portfolios in the long-term by means of steady cash flows. Lease contracts offer the advantage of a relatively high level of security and a low management burden for the property owner. There is a clear distinction between hotel property and hotel management. All in all, lease contracts are useful for a high level of stability in investor portfolios. This aspect is also seen as positive by lenders.

(4) ESG compliance

Hotels have a high CO2 footprint compared to other asset classes. This is why ESG standards are particularly important in the hotel market. The ESG factor must be taken into account at every stage of the life-cycle, including by operators, developers and investors alike. For example, higher building efficiency can lead to lower operating costs, thus increasing operators' profit margin. Nevertheless, the majority of the life-cycle and therefore the highest savings potential lies in the day-to-day operation of the hotel.

ESG criteria are also becoming increasingly important for travellers. More than half of tourists are willing to pay a higher price for sustainable hotel services/products, according to a survey by travel service provider Skift. Likewise, sustainable hotel products/services lead to higher customer satisfaction, which is likely to have a positive impact on demand.

So ESG-compliant assets can not only generate higher cash flows for investors during the holding period, but also raise the value of the property and thus produce higher sales proceeds.

(5) Liquid and sought-after asset class

In 2021 and 2022, an average of about EUR 17.7 billion was invested in hotel properties in Europe. Although this volume was still 30% below the average of about EUR 25 billion achieved annually from 2015 to 2019, a rise in hotel investments is nevertheless noticeable. Despite the increased cost of financing and current economic and geopolitical uncertainties, investment activity in hotel properties continued to rise in the first quarter of 2023. At EUR 4.1 billion, investment in hotels in Europe in the first quarter of 2023 was approx. 18% higher than in the same quarter of the previous year (source: Cushman & Wakefield). So, there is strong interest. Investment activity is currently only being held back by the difference between sellers' and buyers' expectations.

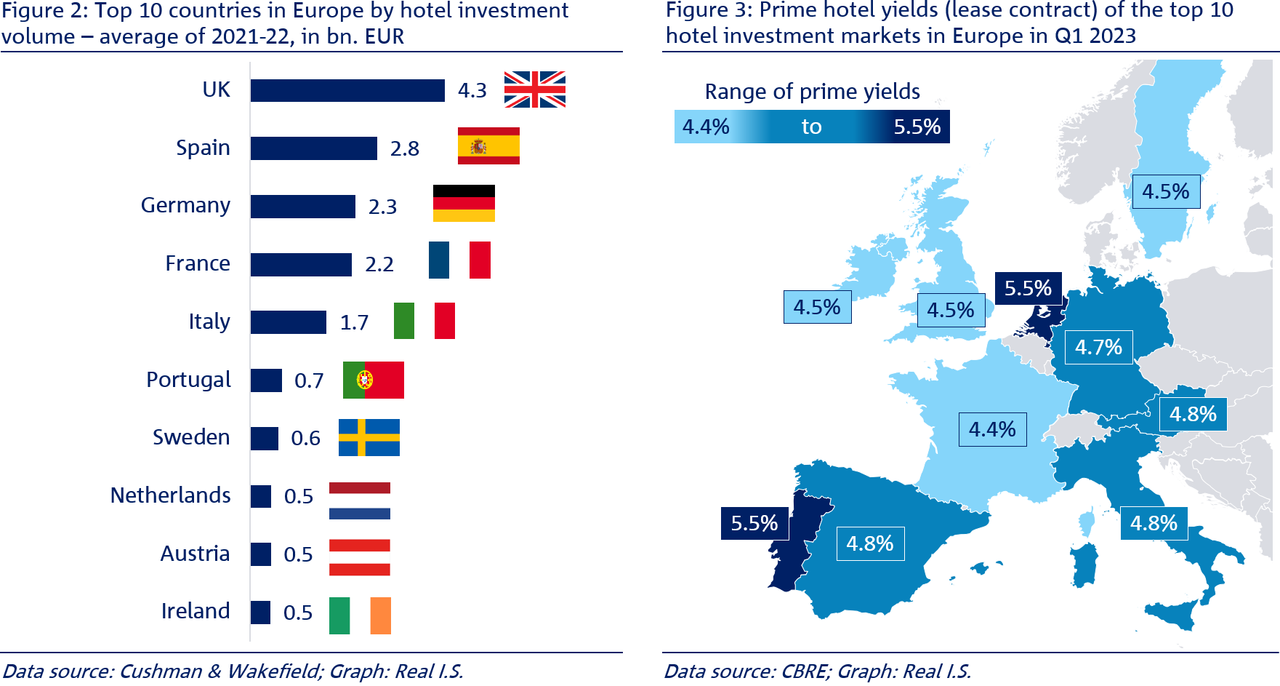

Apart from the United Kingdom in first place, the top hotel investment markets in Europe are Spain, Germany, France and Italy (see Figure 2). Almost 75% of total investment in hotel properties flowed into these five countries in 2021 and 2022. The eurozone countries Portugal, the Netherlands, Austria and Ireland are also liquid and attractive markets.

(6) Attractive yield opportunities

According to Cushman & Wakefield, hotel yields in Europe in the first quarter of 2023 were on average around 70 basis points higher than at the end of 2019, due to the rise in interest rates. In the top 10 hotel markets in Europe, prime yields for hotels with lease contracts were between 4.4 percent and 5.5 percent in the first quarter of 2023 (see figure 3; source: CBRE). The highest prime yields of 5.5% are currently returned by hotel investments in Portugal and the Netherlands. At 4.7%, Germany is in the midfield of achievable yields in the A cities. In German B cities, initial yields are around 5.0% to 5.3%, and in C cities even 5.6% to 5.8%. (source: Immozeit).

This positions the yields on hotel properties above other types of use. In Germany, for example, hotel yields have a risk premium of 80 basis points compared to prime office yields. Compared to the prime yields of the residential property use type, the premium is as high as 170 basis points (source: CBRE)

(7) Low volatility in the portfolio performance

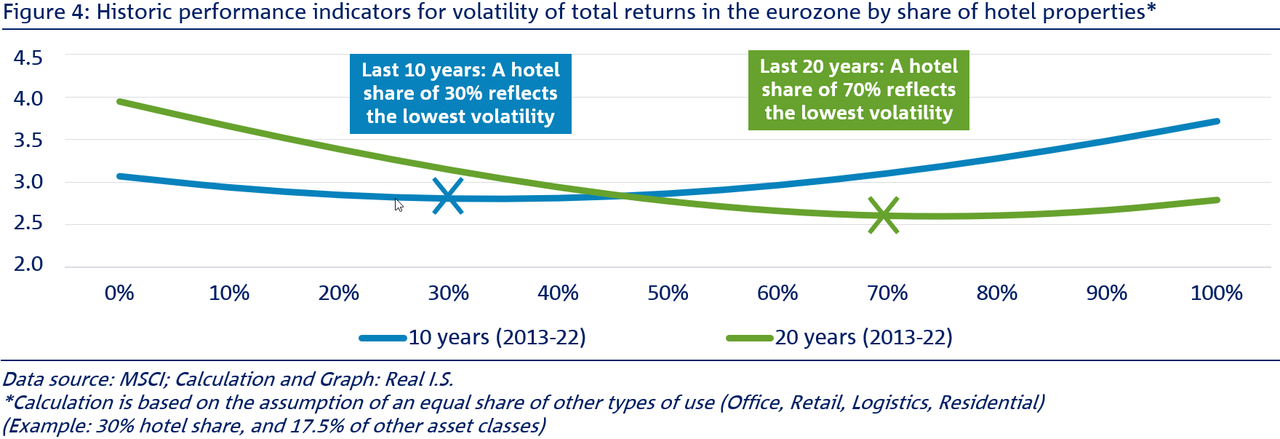

The higher the proportion of hotel properties in a mixed-use portfolio (with additional office, retail, logistics and residential properties), the lower the risk of major fluctuations in the overall investment performance – at least up to a certain level. This is shown by analysis of the total return (= sum of return on capital growth and cash flow return) of real estate portfolios in the eurozone.

The historical performance indicators from data provider MSCI were evaluated and the weighting of hotel properties in the overall portfolio was varied between 0 and 100%. The results show that the volatility of the portfolio decreases as the share of hotel properties increases (see figure 4).

The result varies, depending on the period under consideration. Looking at the last 20 years, portfolio risk fell with a hotel property share of up to 70% – as the share becomes higher, the volatility increases again slightly. Over the past 10 years, the optimal weighting of hotel properties has been 30% in a portfolio in order to minimise fluctuations in overall investment performance.

Summary: hotels are an attractive addition in investor’s baggage

The longing for a holiday is back and demand continues to rise, despite economic uncertainties and high inflation. This is now faced with a moderate development pipeline. Long-term and fixed lease contracts make hotels attractive investments with a constant cash flow, bringing stability to real estate portfolios. This is also shown by the low fluctuation in the total returns of hotel properties in the euro area over the past 20 years. Hotel companies around the world are also implementing more and more measures to become more sustainable, socially effective and ethical. ESG compliance enables investors to increase their cash flow and raise the value of the property at the same time. Hotel properties are therefore investments in a long-term growth market. This could have a further impact on the growing investor interest in hotel properties, and further increase the already high level of liquidity. This is especially the case since hotel investments also generate attractive and relatively high yields. These seven reasons clearly speak in favour of hotels' attractiveness as a type of use.

Regarding ‘pack your bags’ (and the German equivalent pack your seven things): where does this expression come from? ‘Apart from referring to the specific number, seven has always had the meaning everything throughout history. So, when someone packs up their seven things, it does not refer specifically to seven individual items, but to all the belongings’ (source: WDR, public-broadcasting institution). From this point of view, we would actually have to revise our conclusion: hotel properties therefore offer everything that is needed for an attractive investment.

Your contact

Luca Gudewill

Real I.S. AG

Research and Investment Strategy

luca.gudewill(at)realisag.de

Olivia Krebs

Real I.S. AG

Research and Investment Strategy

olivia.krebs(at)realisag.de