Interest rate rise is driving market correction

The price correction on real estate markets is continuing. This is primarily due to the trend in consumer prices: inflation rates are not dropping as fast as many market players expected; accordingly, the ECB is continuing to tighten its monetary policy by raising key interest rates. In consequence, capital market interest rates in the euro area have continued to rise, pushing up the financing costs for property purchases. Real estate has become less profitable due to the higher cost of borrowing. In parallel with this, the rise in capital market interest rates has increased the return on an alternative investment in a risk-free government bond. This makes property investments less attractive, which also reduces demand in the investment market. As a result, the current price correction is likely to continue.

Prices – At what prices?

For the time being, however, it is difficult to quantify the price correction. Current purchase offers for office properties in German A cities are between 10 and 20% lower than the previous year. But is this really the market? Properties are only offered for sale at this time if the seller really needs to sell. Follow-up financing of a maturing loan may have become unviable in view of rising interest rates, for example. Most market players are nevertheless taking a wait-and-see approach to property sales in the current market phase.

Due to the low transaction activity in the investment market for real estate, brokers and real estate data service providers also have to estimate the price fall to some extent. The brokerage firm JLL, for example, sees an average price decline of 16% for office properties in the seven major German cities (calculated from prime rents and prime yields in the first quarter of 2023 versus the first quarter of 2022). Prices in Dusseldorf have remained stable (the rise in prime rents has offset the decline in multipliers), and have fallen by 13% in Cologne and 22% in Frankfurt am Main. However, the independent real estate data provider PMA reports a price decline of 8.2% for Cologne and 27% for Frankfurt am Main. This shows how difficult it is currently to draw conclusions on the basis of data.

The trend in property values held in existing real estate portfolios is also interesting. The portfolio values are not derived directly from the trend in market prices. Instead, a sustainable fair value is determined by a surveyor carrying out a market value appraisal. In the case of office real estate in Germany, the decline in value of portfolio properties in the data universe of financial services provider MSCI was -0.6% in 2022. This means that the decline in value for portfolios was significantly lower than the price fall in the investment market (it should be noted that in the text above, the price decline up to the first quarter of 2023 was presented, while the MSCI data for the valuation of property portfolios was only assessed up to the end of 2022). Since the rise in property prices on the market has generally exceeded the increase in values on an appraisal basis in recent years, a valuation buffer has accumulated, which is now being gradually reduced. However, if the rise in interest rates continues for a longer period, the market value changes in portfolios are also likely to gradually increase in the coming years.

Price correction up to a fair risk premium

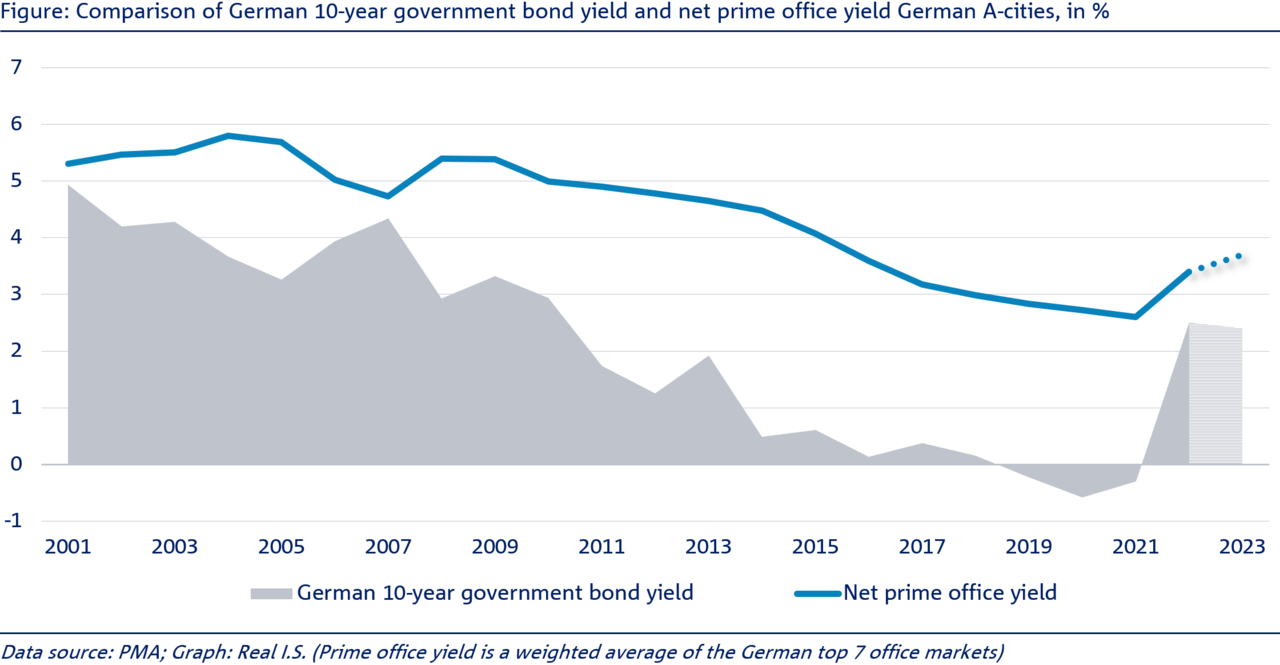

How long will the current price decline continue? Essentially, there is one answer to this question: until real estate yields again offer a fair risk premium over yields on risk-free government bonds. This is possible if capital market interest declines or if real estate yield goes up, i.e. purchase prices continue to fall. Currently, the yield of a 10-year German government bond is about 2.3%. In the seven German major cities (A-cities), the average initial yield on office property purchases is 3.5%. Hence, presently real estate offers a risk premium of 120 base points (see figure below). Historically speaking, the premium was 300 base points (past 10 years), 200 base points (past 20 years) and 150 base points (past 30 years). Estimates of further possible price declines vary in dependence of the historical period on which fair risk premium calculations are based.

But the statistical observations do not adequately take account of the macroeconomic environment. Currently, Germany’s economy is highly inflationary. Property, unlike government bonds, provides inflation protection as contract rents can be adjusted to align with consumer prices (indexation). This would have to be taken into account when calculating a fair risk premium. The risk premium demanded by market players is thus reduced, leading to a lower expected decline in purchase prices.

There is a further reason why the risk premium required by market players could be lower than the historical yield spreads indicate. The real estate yield only shows the static yield expectation at the time of purchase. In an environment where market rents are rising, however, higher property cash flows and consequently rising property yields would be expected over the course of the holding period. Let us look at the market development in 2007, for example, when the yield of the 10-year government bond rose to 4.25% following the interest rate increase cycle of the European Central Bank. In the seven German major cities, average office yield was 4.75% in this period. Transaction volume was high in the real estate investment market and prices went up in 2007, despite a risk premium of just 50 base points. The reason for this trend was the expected strong growth of market rents, and thus higher yield expectations during the holding period.

Expectations of rent growth due to declining supply of new space

Although there are currently no signs of a strong economic upswing that could drive up rent growth expectations in the rental market, another factor points to a brightening environment in the medium term: construction activity is falling due to the rise in interest rates. While there is still a reasonable pipeline for completion of office properties in 2023, a sharp decline is expected in subsequent years. The number of completions in German A-cities (net additions were used here; this is the difference between office completions excluding refurbishments and building demolitions and conversions) will, according to forecasts from data provider PMA, fall to around 670,000 m2 by 2027, about 40% below the current year's level. As soon as demand for space would then increase on the back of an economic upswing, it would face significantly lower supply. This would boost rent growth expectations in the market and, with investment activity seeing a recovery, it would slow or halt the price decline in the investment market.

Conclusion: there is a gradual opening of the window for investments

A precise prediction of when this will occur is subject to considerable uncertainty. For 2024, real GDP growth of 1.1% is expected for Germany according to Consensus Economics (market opinion). This development, combined with the declining supply pipeline, could lead to higher rent growth expectations and thus more demand in the investment market, with property prices stabilising. This will probably result in a favourable period for investment in the course of 2024. When planning a re-entry into the real estate market, it is in any case never very easy to hit the best investment time precisely (low point in the market), since a property transaction takes several months, while building up a portfolio can usually take several years. In this regard, an attractive window of opportunity for investment will in all likelihood open in the period 2024/2025.